What is Forecast Modelling?

All businesses face an uncertain present - and an even more uncertain future. What would it mean to your business to have a more certain future? Do you ask yourself these kinds of questions? And if not – should you?

- What motivates my business?

- What should I change ….and what should I leave alone?

- How can I improve my business performance?

- What are the chances of making more money next year?

- Can I do this project and maintain my cash flow?

Would you drive your car using only the rear-view mirrors?

Financial accounts only tell you where you have been

Financial models look ahead to tell you:

- where a business is going

- what it needs for the journey

- what the destination might look like

- what instruments are needed to measure progress

- what could happen if the business needs to change course

- vehicles, or speed

- what the chances are of something going wrong

- A detailed financial model is a powerful tool which:

- supports “instinct” or “intuition” with unbiased data

- simulates real life uncertainties and events

- enables experimentation

- illustrates the consequences of change

- highlights the pitfalls in failing to achieve performance levels

- helps management to face an uncertain future

It provides the most effective way of forecasting and analysing your business.

What do forecast models do?

They provide new insights into the business and a new recognition of future opportunities and threats and they

- identify the key drivers – what needs to be measured and controlled to help your business grow?

- measure the sensitivity – which drivers most affect the forecast and how are they connected?

- assess the probability – how likely is it that you will reach your target?

- illustrate changing circumstances – what would happen if……?

- Show that perception is not reality – deal with facts not beliefs

- They increase confidence to plan, control and change to winning strategies

- They provide robust, reliable and data driven decision support and allow you to

- Select the optimal combination – which opportunities are the most likely to benefit the business?

- expose the uncertainty – quickly examine all possible scenarios

- communicate the risks – how sure are you about your forecast results?

- provide a mechanism to validate – does the business react to change in the way you thought it would?

- facilitate decisions – banish the perils of “analysis paralysis”

So, overall they enable accurate, efficient and confident decision making.

So when do you need a model?

Financial models are of particular value when a business needs to

- provide credible projections to support funding applications

- develop practical measurement systems to manage growth

- indicate the best combination of competing opportunities

- analyse and improve business performance

How do we begin?

Preparing an effective model is a complex task and requires the involvement of management – it is your model.

The process of building the model encourages management to think widely and deeply about the business;

- What is really important?

- What is apparently important?

- What is only “noise”

Then test, question and experiment with different decisions and scenarios

Together we create a flexible representation of the way you think about your business

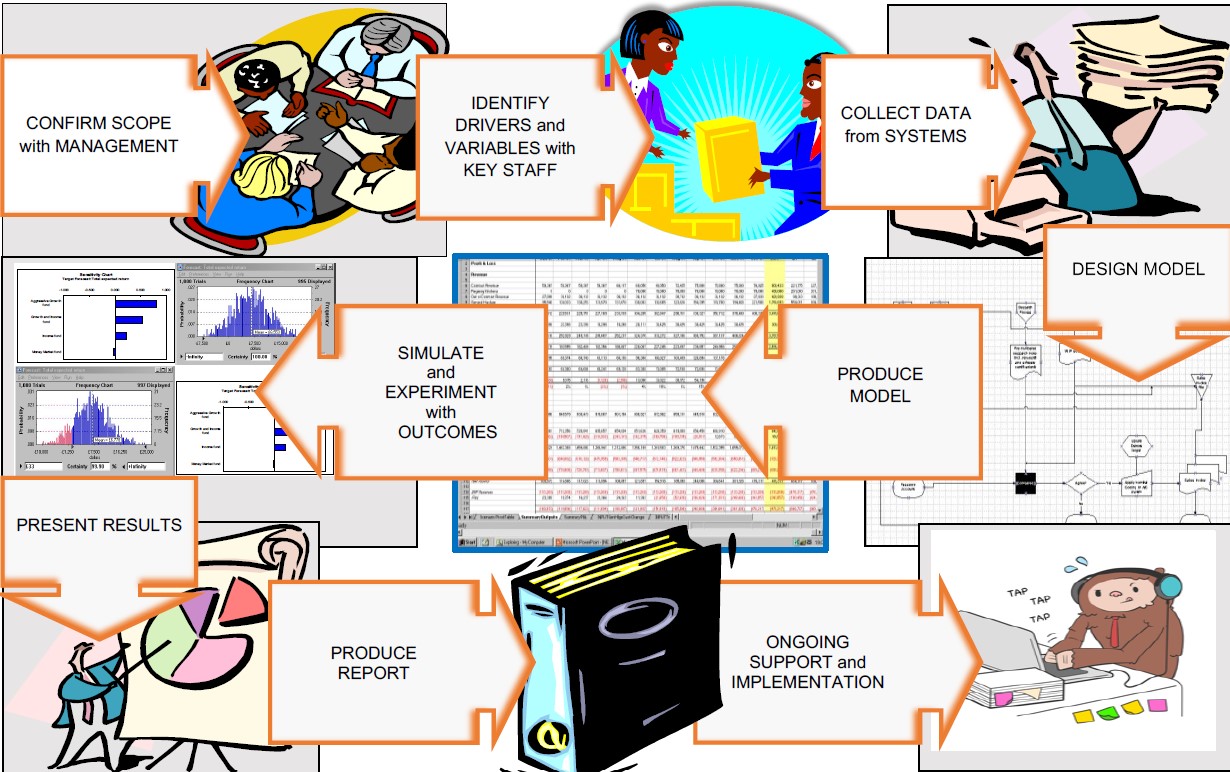

How is it done?